Written By:

Scott Glatstian

Scott Glatstian

Your Dedicated & Trusted Legal Team

3 Generations & 100+ Years of Combined Legal Experience

A last will and testament (often just referred to as “a will”) is a legal document declaring how a person’s assets (money, properties, personal effects) will be distributed after their death. The “testator” is the person who is creating the will. In their will, the testator will determine who will receive their assets, and the manner in which those assets are distributed. Those who they list to receive assets are known as “heirs” or beneficiaries.

As a person begins drafting their will, one question they will need to address is how they’d like their assets distributed in the event that one of the intended beneficiaries passes away before them. There are two possible ways to designate this distribution: either ‘per stirpes’ or ‘per capita’. Choosing one method of distribution over another can have a major impact in how one’s assets are ultimately distributed, so it is important to fully understand these terms prior to drafting a will.

Per Stirpes vs. Per Capita – What’s the Difference?

Per stirpes in Latin means “by branch.” In a legal context, this refers to the idea that if an heir dies, their share of the assets will automatically be distributed to that heir’s descendants (a person born in a direct biological line). The Latin refers to how the assets are distributed along the same family tree branch through direct descendants.

In contrast, per capita in Latin means “by the heads.” Regarding wills, this means that if an heir dies their share of assets will be equally distributed to the other remaining heirs. The Latin here refers to the heads or heirs of the assets.

The best way to understand these phrases and their application is through examples of different scenarios.

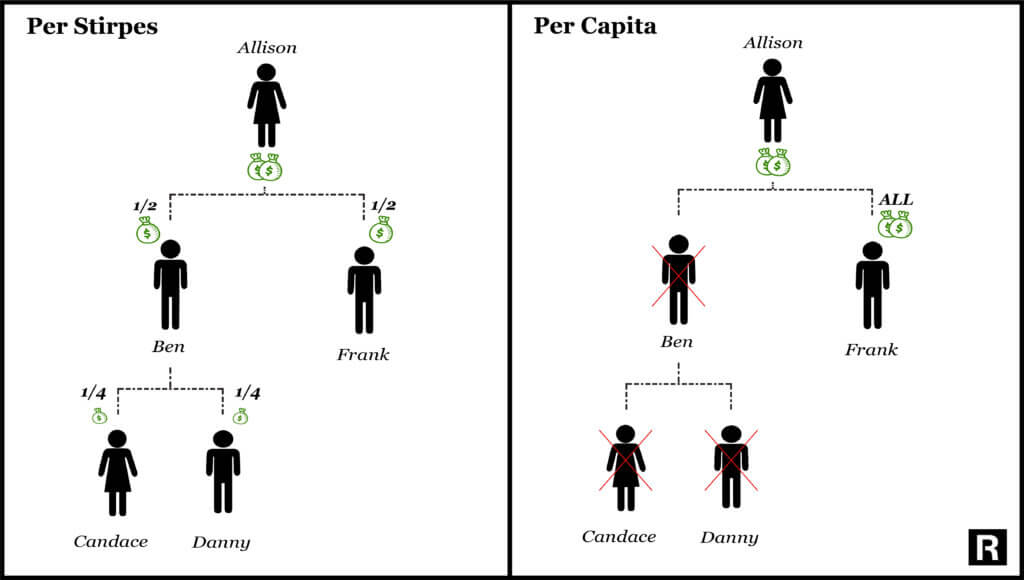

Imagine that a woman named Allison has two children and wrote a will including them as her primary beneficiaries. She followed the per stirpes distribution and declared that all of her assets would be divided equally amongst them. There’s Ben, who has two children, Candace and Danny. And Frank, who has no children. When Allison passes away, Ben and Frank will each receive one half of their mother’s estate.

If Ben passes away before his mother does, using a per stirpes distribution of Allison’s assets, Ben’s share of the inheritance will be allocated automatically to his most direct descendants, in this case his two children. So Candace and Danny will each receive one half of Ben’s half of his mother’s assets, or one quarter each.

Now, let’s look at the alternative scenario. Allison has the same two-way split for her assets, but she uses a per capita distribution. Once again we’ll assume that Ben passes away before his mother, Allison. This time, however, the resulting distribution will be different. Rather than splitting Ben’s share between his two children–as was the case with the per stirpes method–in a per capita distribution, Allison’s assets will be divided only amongst living children upon her death. In other words, with a per capita distribution, Ben’s children will receive nothing and Allison’s entire estate will go to Frank.

How Do I Decide Which Method of Distribution Is Best?

Deciding the method of distribution depends on the person and their specific family and financial circumstances. For most families, the per stirpes distribution is often chosen if the testator’s heirs are their children, and they want their grandchildren to inherit their children’s shares should anything happen to the child prior to their passing.

However, the per capita distribution allows for more flexibility and specificity in how the testator distributes their assets. This may be helpful for situations where the family dynamic is more complicated or the beneficiaries are not the testator’s children. For example, if the beneficiaries are close friends of the testator but not related to them, the per capita option may be more reasonable to ensure only the intended beneficiaries are receiving the assets, not their relatives or other heirs.

Sometimes the per capita approach may make sense when one of the testator’s children is much more wealthy than the others, and can therefore provide for the testator’s grandchildren with or without receiving an inheritance. Here, the per capita option would result in the money going to the other surviving children to provide for their children (the grandchildren of the testator).

Ultimately, the decision on how to pass along assets to heirs will depend on the specific circumstances of the individual creating the will. There is no one “correct” distribution to use. An experienced attorney can help determine which distribution method will best match a testator’s desired outcomes.

If you have questions about these two different approaches or anything involving estate planning, contact Rosenblum Law. Our skilled attorneys can assist you in creating a will and other necessary estate planning documents. Call us at 888-883-5529 for a free consultation today.

Scott Glatstian

Scott Glatstian

About The Author

Scott is an Of Counsel Attorney for Rosenblum Law. He is a graduate of Syracuse University College of Law and received his undergraduate degree from Rutgers University.

Read MoreLatest from Our Blog

Editorial Standards

Rosenblum Law is committed to delivering informative content of the highest quality. All content is subject to our rigorous editorial standards for relevance, accuracy, sourcing, and objectivity. Everything is fact-checked by an editor and reviewed for legal soundness by one of our practicing attorneys prior to being published.

How to Cite Rosenblum Law’s Article

APA

Scott Glatstian (Jul 25, 2022). Estate Planning Is About Helping Your Family. Rosenblum Law Firm, https://rosenblumlaw.com/estate-planning-is-about-helping-your-family/

MLA

Scott Glatstian "Estate Planning Is About Helping Your Family". Rosenblum Law Firm, Jul 25, 2022. https://rosenblumlaw.com/estate-planning-is-about-helping-your-family/