Get Started On Your Estate Plan Today

Your assets will be distributed both according to your wishes and halacha.

Your healthcare team will follow halacha when providing medical treatment.

Your post-mortem care will be provided in accordance with halacha.

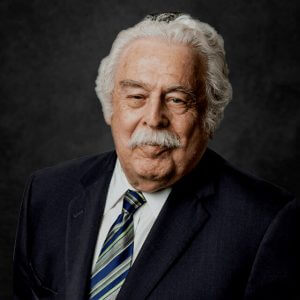

Featured Client Testimonial

Our Working Process in 5 Steps

Contact Us

Speak with an attorney about your circumstances and the estate plan you want to create.

Step-1

Gather your Information

Use our client portal to gather information on your assets, desired beneficiaries and other information your attorney will need to create your estate plan

Step-2

Meet with Us

Meet with an attorney for a longer discussion about your desired estate plan. Our attorneys will use the information to create the plan that best meets your needs.

Step-3

We Get to Work

Our attorneys will draft the estate plan and provide you with a copy for comments and edits.

Step-4

Signing and Storing

Once you are satisfied with the estate plan we have created we’ll provide instructions on signing and storing the documents so that they are legally valid and available when needed.

Step-5Estate Planning Solutions

Last Will and Testament

Designate how your assets will be handled upon your passing. Name guardians for minor children.

Living Trust

Create a new entity to hold your assets and designate how they are to be distributed while you are living and when you pass. Avoid probate. Protect assets from creditors of beneficiaries.

Living Will

Provide your proxy, healthcare team and loved ones with instructions on how your healthcare should be handled in the event you are incapacitated. Designate organ donor status, ensure compliance with religious requirements.

Durable General Power of Attorney

Designate a person (and backups) to make decisions regarding your finances to protect your assets in the event you become incapacitated.

Probate

Learn the process of settlign one’s estate in the court system.

Estate Litigation

“Estate litigation” generally refers to legal disputes over the assets of a person who has died. If the decedent didn’t have an estate plan upon their death, the risk for disputes is often greater than if they had an estate plan.

What happens if I die without a will?

If you die without a will, a court will usually appoint an administrator to wind up your estate. New Jersey’s intestacy laws will also determine how your assets are distributed.

Intestacy laws often don’t reflect how someone would want their assets to be distributed. Determining who’s entitled to your property can also be a lengthy, expensive, and contentious process. So when planning your estate, it’s best not to rely on these laws.

If you have minor children and don’t appoint a guardian in your will, a court will choose guardians for them. This might happen anyway, if you make an inappropriate choice for the guardian.

Does New Jersey have an estate or inheritance tax?

- New Jersey no longer has an estate tax, but it does have an inheritance tax. The inheritance tax rate is based on the relationship of the beneficiary to the person who died. Certain beneficiaries are exempt from inheritance tax, such as spouses, children, and charitable organizations.

You should also be mindful of federal tax obligations. Larger estates in particular may be subject to federal estate, gift, or GST tax.

A lawyer can help you navigate state and federal tax laws and minimize the impact on your estate.

What is a trust?

A trust is an arrangement in which a trust maker puts assets into the care of a trustee for the benefit of one or more parties called beneficiaries.

There are two main types of trusts that you can establish while you’re still alive:

- revocable living trusts

- irrevocable living trusts

Living trusts are established with a trust document or agreement. The trust document also determines how the trust assets are held, managed, and distributed.

A trust that is only formed upon your death under your will is called a “testamentary trust.” The terms of a testamentary trust are included in the provisions of your will.