Share this Image On Your Site

Infographic Definitions and Links to Further Information

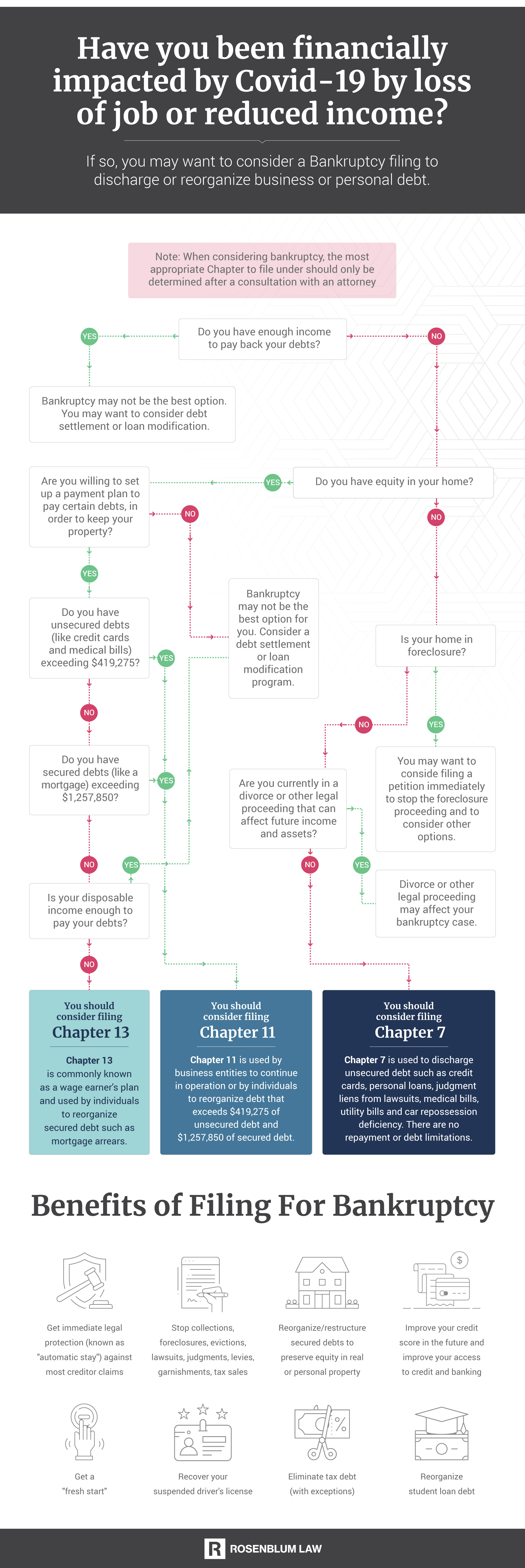

- “You may want to wait before filing” – *Eligibility is based on one’s previous 6 months of income averaged together and may affect timing to file.

- “Do you have a lot of equity in your home” – *Home equity can be used to pay off creditors in a Chapter 7 proceeding, subject to certain exemptions.

- “Are you currently in a divorce….” – *Legal proceedings that can impact one’s finances will affect the timing of when they should file for bankruptcy.

- “Consider filing an emergency petition” – *This will begin an automatic stay which will halt a foreclosure proceeding immediately and until the bankruptcy proceeding is complete

- “Do you have other valuable property you want to keep” – *Developing a Chapter 13 repayment plan is the best way to keep one’s property during a bankruptcy proceeding.

- “Does the value of your assets exceed your debts” – *Those with valuable assets will need to repay at least their value to creditors in a Chapter 13 proceeding, subject to certain exemptions.

- “Do you have unsecured debt…” – Learn more about unsecured and secure debt here.

- “Is your disposable income….” – *Disposable income is calculated by subtracting necessary expenses from one’s regular income, all disposable income is expected to be used to pay off creditors in a Chapter 13 bankruptcy

About Rosenblum Law

Rosenblum Law helps individuals in the state of New Jersey file for bankruptcy. Our attorneys and co-counsel have over 30 years of combined bankruptcy and debt settlement experience. Our lawyers can help you file bankruptcy to eliminate debts from credit cards and medical bills and stop wage garnishments and collection calls. Our lawyers are compassionate and provide personalized care to each one of our clients. For a free bankruptcy consultation call: 888-815-3649

While you may not be able to submit the petition and initiate the bankruptcy proceeding while the courts are closed, you can still begin the preparation of documents and finances to determine eligibility so that you are prepared to get started right away when the courts reopen or return to their full capabilities.

Not yet. The means test is determined by averaging the previous six months of one’s income from all sources. If you failed today but anticipate reduced income in the near future, you may be able to pass the means test as soon as these future months are added into the calculation.

Yes. Any unemployment benefits received, whether from the state or federal government, are considered taxable income that will need to be included in the means test when determining eligibility to file Chapter 7 bankruptcy.

It depends on your specific situation. Divorce settlements often involve the transfer of assets between the couple, and these assets can affect a person’s eligibility to file. In addition, new assets from a divorce may be subject to sale through the bankruptcy estate if not protected by an exemption. Anyone thinking of filing for bankruptcy while going through a divorce should consult with an attorney first to determine their best options.