Written By:

Salvatore Nuzzo

Salvatore Nuzzo

Your Dedicated & Trusted Legal Team

3 Generations & 100+ Years of Combined Legal Experience

The term “phantom vehicle” may sound odd when talking about real-life accidents, but it’s a common term in the insurance industry. A phantom vehicle is an unidentifiable vehicle that played a role in an accident.

If there’s a hit-and-run accident with no witnesses and no cameras, the vehicle that fled could be considered a phantom vehicle. Another example would look like this: Car 1 cuts off Car 2. Car 2 swerves and brakes, colliding with Car 3. Meanwhile, Car 1, which was not struck, drives off seemingly unaware of the crash that occurred behind it.

However it happens, a crash involving a phantom vehicle complicates accident claims, especially when a truck is involved.

Phantom Vehicles in New Jersey

There are different interpretations and applications of phantom vehicle laws. In a New Jersey auto accident case, if a phantom vehicle is determined to be the cause in part or in whole, that phantom vehicle can be named as a liable party in a personal injury lawsuit. Of course, you can’t actually sue someone you can’t identify, so what this does is trigger an uninsured motorist claim against your own insurance company.

If there is more than one vehicle involved in the accident, including a ‘phantom vehicle’, then those other parties can be sued in addition to filing an uninsured motorist claim. However, there are two things that must be true for that to happen.

1. The existence and involvement of a phantom vehicle must be corroborated by two unrelated parties. Using the three-car incident example above, the drivers of Car 2 and Car 3 must both independently state that Car 1 cut off Car 2 before Car 2 swerved into Car 3 for the uninsured motorist clause to kick in for any injured person. Similarly, a third-party witness, such as another motorist not involved in the crash or a pedestrian watching from the sidewalk, can corroborate the involvement of Car 1 as a phantom vehicle.

2. The suing party must be determined to be less than 50% at fault in the accident. If the driver of Car 2 is deemed to carry 55% of the blame (perhaps he or she was texting or driving aggressively), then the Car 2 driver cannot access the uninsured motorist coverage and cannot sue Car 3 for damages. However, the driver of Car 3 can sue the driver of Car 2 as well as file an uninsured motorist claim.

Phantom Vehicles in New York

New York State also allows an unidentified vehicle contributing to an accident to trigger uninsured motorist coverage. However, New York requires that the phantom vehicle make an impact (physically hit or come in contact with another vehicle). In other words, if there is a hit-and-run scenario, an injured person can access his/her uninsured motorist coverage. But in the three-car example used earlier in this article, the drivers of Car 2 and Car 3 cannot file uninsured motorist claims, since Car 1 did not make an impact with either vehicle. Also unlike New Jersey, New York personal injury law allows drivers to sue for damages and injuries even if they are found to be more than 50% at fault in the accident.

How a Truck Changes Phantom Vehicle Accident Cases

Accidents involving phantom vehicles can be complicated from a liability standpoint. But when a commercial vehicle is one of the vehicles involved in the accident, it adds new factors and can change how a person recovers damages for injuries.

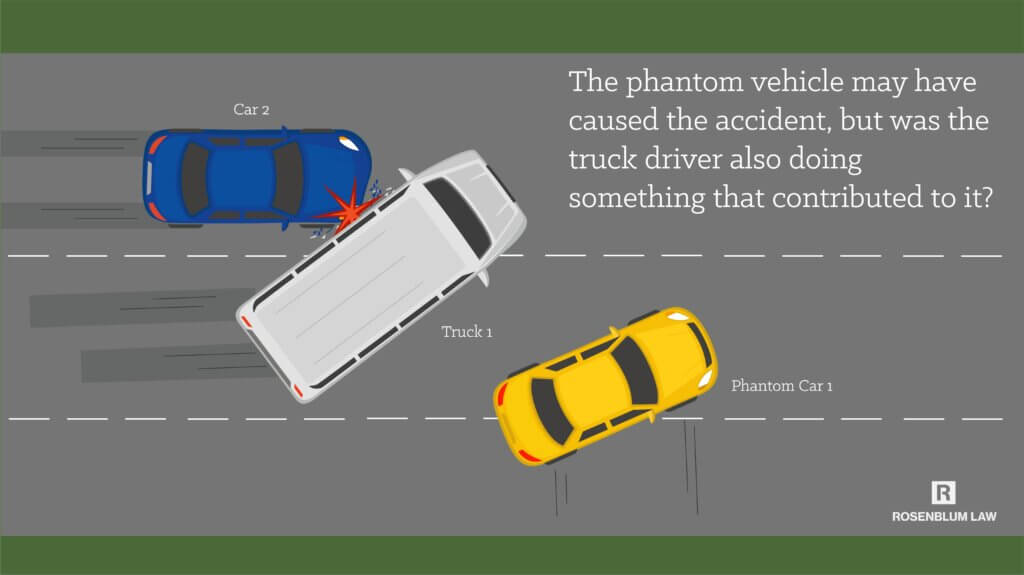

Let’s go back to our three-car example but throw a truck into the mix. Phantom Car 1 cuts off Truck 1, which swerves and hits Car 2. Right off the bat, a truck driver is likely going to be held to a higher standard than a regular driver. An officer filling out an accident report and the attorneys for the injured party are going to scrutinize that trucker much more. Sure the phantom vehicle caused the accident, but was the truck driver following too closely? Was the trucker taking the load into account when setting his or her speed?

The truck driver also sits up higher and can see farther ahead than a regular driver. He/she is trained more frequently and drives a lot more often than a regular driver. He/she is supposed to know the rules of the road and be more mindful than a regular driver. All of this will come into play and, as unfair as it might seem, a truck driver is likely to carry more blame than another driver in the same situation, all things being equal.

The reason for this is not just that the trucker is a professional, but also that he/she has much higher insurance coverage. Federal law requires a commercial vehicle to be insured with at least a $1 million policy, which will cover a lot more than the average person’s auto insurance policy. So, even if the truck driver is not the at-fault driver, if he/she has any culpability, he/she will very likely become part of the recovery process for the plaintiff.

Truckers Have the Deepest Pockets

When you are injured in an accident, you have cause to sue all negligent parties. Normally, each party is on the hook for the percentage that they are found at fault. However, most drivers have very little coverage: The minimum policy in New Jersey is $15,000 per person or $30,000 per accident, while in New York it’s $25,000 per person and $50,000 per accident. Once a defendant’s insurance coverage is exhausted (including the injured party’s uninsured motorist coverage), it makes sense that the plaintiff goes after the trucker for the rest.

In fact, it’s not unheard of for drivers to sue only the truck driver regardless of how much at fault they were in the accident. For truckers employed by a large corporation or commercial carrier company, this can work to the company’s advantage. Many times, trucking companies want control of the claim. They don’t want other parties’ attorneys involved; it could mess up the narrative and result in a settlement that is less than ideal for the trucking company.

In accidents involving multiple vehicles, the trucking company sometimes attempts to recover some of the damages from other parties after the settlement—including from the injured party’s uninsured motorist coverage. Each case is different.

If you’ve been injured in an accident involving a truck driver and/or a ‘phantom vehicle’, you need to speak with an attorney who can advise you on the best course of action, who to name in a lawsuit, and how to approach it. At Rosenblum Law, we have decades of experience handling accident settlements and will work with you to get the compensation you need to recover both financially and emotionally.

Salvatore Nuzzo

Salvatore Nuzzo

About The Author

Salvator Nuzzo has spent more than 30 years as an insurance adjuster for various major insurers. Throughout his career, he has handled an estimated 8,000 claims.

Read MoreLatest from Our Blog

Editorial Standards

Rosenblum Law is committed to delivering informative content of the highest quality. All content is subject to our rigorous editorial standards for relevance, accuracy, sourcing, and objectivity. Everything is fact-checked by an editor and reviewed for legal soundness by one of our practicing attorneys prior to being published.

How to Cite Rosenblum Law’s Article

APA

Salvatore Nuzzo (Sep 7, 2018). How a NY Traffic Ticket Impacts Quebec Drivers. Rosenblum Law Firm, https://rosenblumlaw.com/how-a-ny-traffic-ticket-impacts-quebec-drivers/

MLA

Salvatore Nuzzo "How a NY Traffic Ticket Impacts Quebec Drivers". Rosenblum Law Firm, Sep 7, 2018. https://rosenblumlaw.com/how-a-ny-traffic-ticket-impacts-quebec-drivers/